The light at the end of the tunnel

part 1 part 2 ; part 3

SAVING STRATEGIES

Savings strategies have become extremely popular, and less frequent wardrobe updates, the purchase of clothes on promotions and sales, switching to cheaper things, changing the place of shopping and shopping in markets, discounts and outlets have become widespread.

One of the most popular strategies to reduce the frequency of purchases in 2015 was followed by 34% of respondents, and in 2017 by 30%. Another way of saving – buying things at sales and on shares – in 2015 became relevant for 13% of respondents, and in 2017 for 11%. In 2015 and 2017, 3% and 1–2% of the study participants switched to cheaper clothes and buying things at discounts and outlets, respectively.

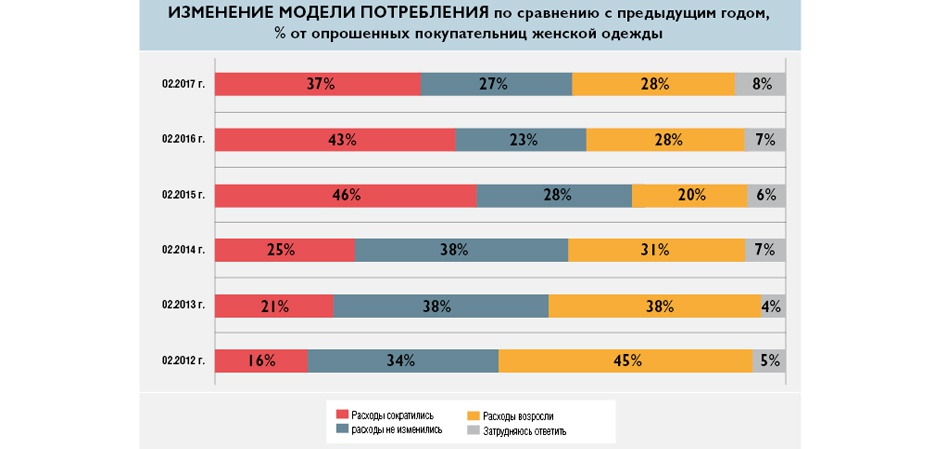

A significant part of Russian consumers are striving to reduce costs. So, for the periods from February 2015 to February 2016 and from February 2016 to February 2017, 43% and 37% of the surveyed buyers of women's clothing reduced their expenses, 23% and 27% did not change them, and 28% increased them.

A more rare wardrobe update has become a popular way to save money for buyers of men's clothing. This line of behavior in 2016 and 2017 was followed by 24% and 17% of respondents. 8% and 9% of respondents in 2016 and 2017 preferred sales and promotions, 2% and 3% switched to cheaper things, and 1% and 2% started shopping at discounts, outlets and markets.

Interestingly, a smaller part of the surveyed consumers of men's clothing, compared with the female audience, reduced expenses, and the majority remained true to the usual pattern of behavior and did not change the cost of purchases. The first strategy was followed by 30% of respondents in the period from February 2015 to February 2016, and 24% from February 2016 to February 2017. The second line of behavior was chosen by 25% and 33% of respondents, respectively, at the specified time intervals.

Traditionally, Russians try not to save on goods for children, which is especially noticeable in comparison with the behavior of domestic consumers when buying women's and men's clothing. Only 13% of the surveyed clothing buyers in 2015 and 7% of those involved in the study in 2017 updated the children's wardrobe less often. 8% and 5% of respondents in 2015 and 2017, respectively, used stock offers and sales, less than 3% switched to cheaper clothes, and less than 2% preferred markets, discounts and outlets. Moreover, most of the consumers involved in the surveys - 53% in the period from February 2015 to February 2016 and 56% from February 2016 to February 2017 - increased their expenses.

And the most important thing is that the results of the survey show that there has already been a downward trend in the share of those who reduce costs, and the part of respondents who increased expenses has increased somewhat, which is clearly visible in the children's clothing segment. This indicates the prerequisites for stabilizing the situation and approaching a way out of the crisis.

SHOPPING PLANNING: WAITING FOR STABILIZATION

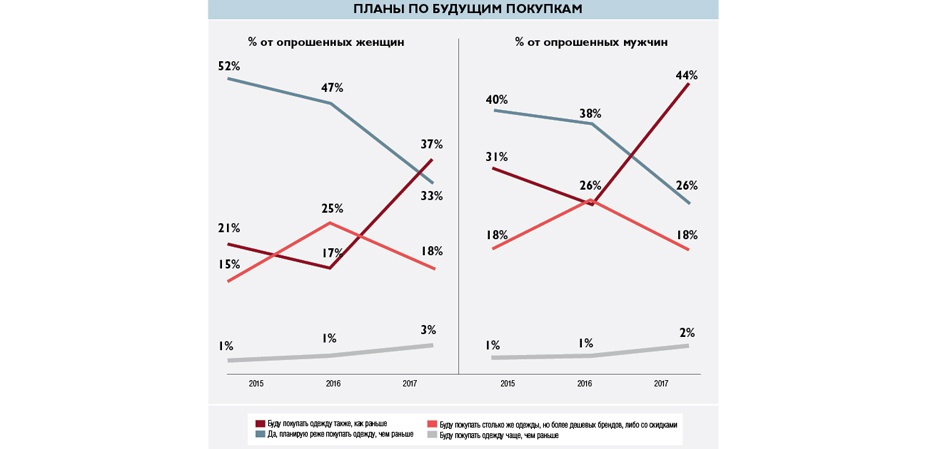

Changes in the expectations and hopes of Russian consumers who are tired of the long-running crisis are associated with the results of a survey on shopping planning, indicating that savings strategies are gradually fading into the background.

In the women's clothing segment, the number of respondents who would like to reduce the frequency of purchases is noticeably decreasing. So, in 2015, 52% of respondents were going to buy clothes less often, and in 2017 only 33%. The share of those who intend to maintain the level of consumption has increased from 21% to 37%, while in 2017 a smaller part of the study participants, compared with 2015, are interested in more affordable brands and discounts.

Similar patterns are typical for buyers of men's clothing. For example, in 2017, the share of those who planned to make purchases less often fell to 18% compared to 31% in 2015, while the number of those wishing to keep consumption at the same level increased significantly to 44% in 2017 from 26% in 2016. From 26% in 2016 to 18% in 2017, the part of those respondents who would like to switch to products of more affordable brands, as well as take advantage of discounts, decreased. The results of the study show the stability of the audience's behavior and adherence to habits.

In general, the study showed that the survey participants are more interested in stabilizing and maintaining the level of consumption than in increasing spending. Russian buyers, whose behavior is becoming more active, are striving for positive changes, but they refuse to spend unnecessarily and thoughtlessly.

To be continued.

Text: Elena Varnina

Photo: shutterstock.com