Russian fashion market shows growth

part 1 part 2

Experts' forecasts regarding the development of the industry are becoming more and more positive, and even pessimistic forecasts give positive dynamics. Anna Lebsak-Kleimans, CEO of Fashion Consulting Group, tells about the situation in the fashion industry market.

The market volume in ruble equivalent is comparable today with 2011 2012.

According to the market analysis conducted by Fashion Consulting Group specialists, with an optimistic forecast (2017FO), the market growth will be up to 9% in rubles (11.5% in US dollars). This scenario can be implemented in case of further improvement of the macroeconomic and political situation, an increase in oil prices and a stable strengthening of the ruble exchange rate. With a pessimistic forecast (2017FP), growth will be up to 5% in rubles and up to 4.8% in dollars, and this will happen if the current pace of economic development and stabilization of oil prices are maintained.

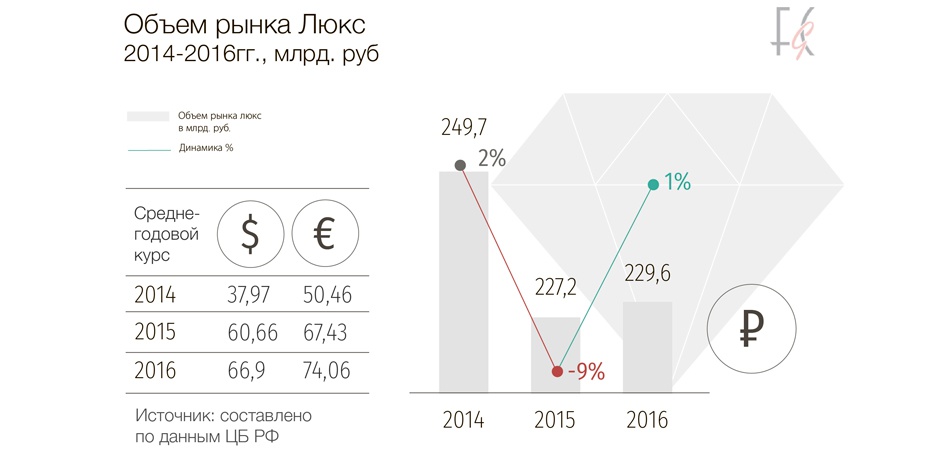

Luxury is the most stable of all segments

The luxury market has reached stable indicators. If in 2015 there was a negative trend (minus 9% in rubles), then at the end of 2016 the market became more stable and reached plus 1%. This was largely due to the strengthening of the ruble exchange rate. The second factor is the reduction of outbound tourism, as a result of which part of the purchases in the luxury segment flowed to Russia. The third factor is that the sellers themselves changed their policy and began to restrain price growth.

The growth of the market in 2017 will continue under the mandatory condition of stabilization of the ruble, positive dynamics of the gross domestic product and low inflation. Actually, the positive dynamics of 2016 arose mainly due to the fact that the ruble strengthened and became more expensive. You can also identify several other factors:

- The emergence of "deferred demand" (which in the current crisis was possible only in the luxury segment and does not apply to the middle and lower). Rich people with incomes in foreign currency will continue to buy and will probably increase the number of purchases in comparison with unstable 2014 and 2015.

- Reduction of the share of shopping tourism against the background of price adjustments by key Russian luxury operators.

- The development of the global online trade in premium goods, which led to the equalization of prices for "luxury" in many countries.

- A significant increase in the number of tourists from China and a service policy aimed specifically at this target audience, which has already borne fruit in 2016, in particular for Mercury.

- Stabilization of the ruble, as a result of which highly paid professionals will return for premium purchases, a category that "fell out" in the crisis.

About 30% of the market of civilized trade falls on major players

At the moment, the top 10 players stand out in the Russian fashion market, which together occupy 30% of the civilized market. The leader in revenue for 2016 is the Inditex Group of Companies - 71.4 billion rubles, or 4.2% of the total market volume. The second place is occupied by Austin LLC with revenue of 37.8 billion rubles. Third place – Corporation «Gloria Jeans», 34 billion rubles.

The fastest growing network was the Zenden Group. Its revenue for the year has almost doubled by 77% at once. This happened mainly due to the purchase of Thomas Munz and Mascotte networks. In addition to the Zenden Group, high revenue growth rates were also distinguished by the companies TC «Surname » (+41%) and the Corporation Gloria Jeans » (+40%). The largest decline in revenue was shown by the company "Center"Shoes", it lost more than half of its revenue (61%). In March 2017, the Moscow Arbitration Court declared the shoe chain "TsentrObuv" bankrupt.

To be continued.

Author: Anna Lebsak-Kleimans