In the fall , they count

RENT CHEAP

According to JLL, rental rates in Moscow shopping centers remained unchanged throughout 2017: the maximum rental rate for premises with an area of 100 sq. m. on the first floor of the shopping gallery remains at the level of 195 thousand rubles per sq. m. per year, the average in the shopping gallery is 74 thousand rubles per sq. m. per year.

CBRE, in turn, notes that during 2017, the pricing policy and the ranges of rates expressed as a percentage of the turnover in Moscow shopping malls changed depending on the category of the tenant. So, the categories "cosmetics", "entertainment", DIY, "gadgets" and "children's goods" showed an increase in turnover. The turnover of the categories «jewelry», «BTI», «accessories» and «cinema», on the contrary, showed a decrease.

According to Evgenia Khakberdieva, head of the department of shopping centers of the Department of retail real estate at Knight Frank, 29 new international brands entered the Russian market in 10 months of 2017. During the same period of the previous year, 45 international operators opened their stores. Thus, the decline compared to the previous year was 35%.

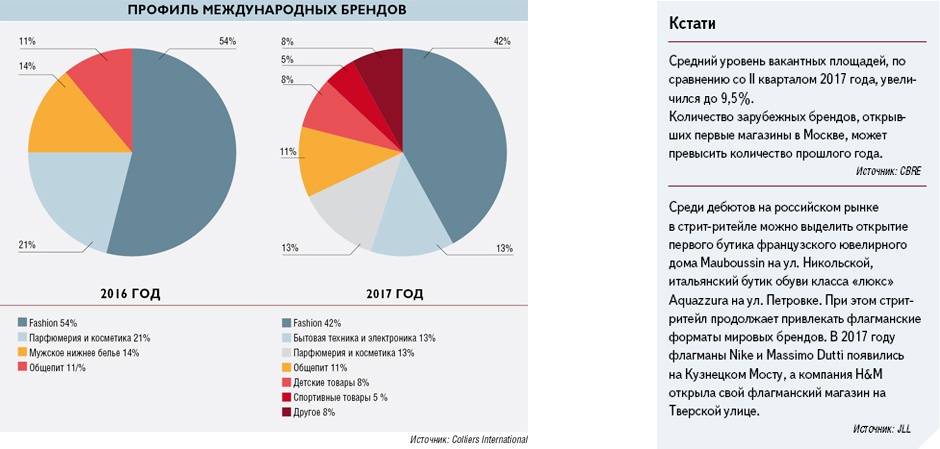

This year, the distribution structure of new operators by profile coincides with the trends of the previous year. The largest share is occupied by the operators of the profile "clothing, shoes, underwear". For 10 months of 2017, 10 brands of this profile opened their stores (34.5% of the total number of new players), last year this figure was 21 stores (46.7% of the total number of new players). The further distribution of brands by profile differs somewhat in 2016 and 2017: for example, last year 7 international cosmetics and perfumery operators (15.6% of the total) and 6 international catering operators (13.4% of the total) appeared on the market.

In 2017, international operators of children's clothing, sporting goods, as well as equipment and electronics developed more actively. Each profile was represented by three new stores in Moscow and the regions, and their share is 10.4% of the total number of foreign players.

Both in 2016 and in 2017, new international players prefer to open their first stores on the Russian market in shopping centers: in 2016, the share of such openings in various shopping centers was 69% (31 stores out of 45), in 2017 this figure was 75.9% (22 stores out of 29).

Moscow still remains the most preferred city for new international operators to enter the Russian market. In 2017, only 4 foreign players chose other cities to start: 2 premiere openings were held in St. Petersburg and one each in Samara and Belgorod. Thus, 86.2% of the total number of new international brands opened in the capital.

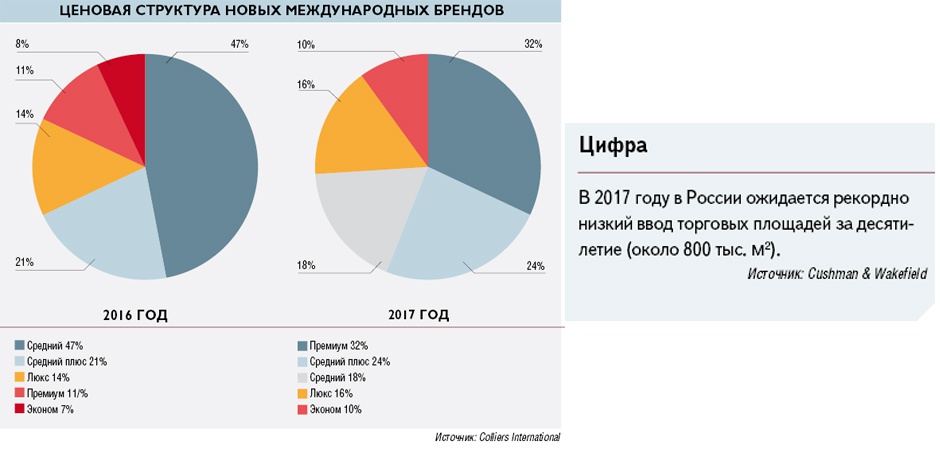

This year, 62% of the operators that entered the Russian market are positioned in the high price segment, a year earlier there were 44% of the total.

Among the new brands are the Hanro underwear boutique (Switzerland); the opening of the second brand of FABI – monobrand boutique of men's shoes Barracuda in GUM; the first in Russia monobrand children's clothing store of the premium segment Il Gufo in the shopping center Petrovsky Passage, as well as the return to the Russian market the Italian brand of bags and accessories Mandarina Duck, which opened its flagship boutique in the shopping center "Metropolis". According to the announced plans, about a dozen more international network companies are planning to implement their projects on the Russian market, which should eventually ensure the output of new brands at the level of 2013.

In general, the level of activity of international retailers in the first three quarters is comparable to the same period in 2016, when 37 new brands appeared on the market (compared to 34 this year).

The greatest interest in the Russian market is shown by foreign brands from European countries - 26 new retailers (76%). The leading country among the debutants of the Russian market is traditionally Italy: it accounted for one third of the new discoveries of 12 new brands.

Fashion segment operators traditionally represent the bulk of foreign debuts on the Russian market - about 50%.Despite the fact that, according to CBRE, since the beginning of 2017, five international brands have announced their intention to leave the Russian market: C&A, Takko Fashion, Finlayson, Mexx, Accessorize and Mamas and Papas.

To be continued.

Text: Ekaterina Reutskaya

Photo: shutterstock.com