Kering Group's not-so-good plans

At the annual shareholders' meeting of the Kering group of companies in Paris, its executive director Francois-Henri Pinault outlined a very ambitious strategy according to which Kering should become "the most influential group in the world of luxury».

Over the years of leadership Pinot transformed Kering from a simple combination of disparate companies into a unique unified system, completely focused on the luxury business, with a market capitalization of 67 billion euros. Last Wednesday at a meeting of 335 shareholders at the Kering headquarters on Rue de Sèvres Pinot spoke about the achievements of the entire group for 2018, including the continued double-digit sales growth at Gucci and Saint Laurent. The latter, by the way, showed an increase of 19% against the background of continued growth of more than 20% for seven consecutive years. Pinot highlighted the potential of Balenciaga, which should cross a new sales milestone of a billion dollars in 2019, as well as Alexander McQueen. There is still a lot of work to be done at Bottega Veneta , although, as previously reported by the CFO of Kering Jean-Marc Duplo, the recently introduced products from the new creative director of Daniel Lee are selling very well.

The company continued to strengthen its progressive reputation. Chief Sustainability Manager Marie-Claire Daveau spoke about the initiatives of 2019, focusing on animal policy (for which a new set of standards will be announced soon), land use and biodiversity protection.

Also on Wednesday, the annual review of the non-profit association Fashion Revolution"200 public disclosures of major brands and retailers" was published. On average, companies received a rating of 21% for the transparency of their supply chains. The rating of Gucci was 40%, Bottega Veneta – 39%, and Saint Laurent – 38%. At the same time, the brands of the Kering group were the most highly rated among luxury brands.

As for other areas of corporate responsibility, the group stated that it plans to make an announcement in May at the fashion summit in Kopegagen regarding a charter aimed at improving the working conditions of models, first created in partnership with a competitor of the group LVMH in 2017.

Pino also told why in 2018 the group terminated its 50-50 partnership with Stella MCartney, despite the fact that Stella McCartney's ideals are close to Kering's views on corporate responsibility. "It's not that we haven't tried to preserve this partnership. As part of an agreement concluded with McCartney in 2001, she was given the opportunity to buy back shares owned by Kering at certain points in the development of the business. And in 2018, this moment has come. Stella remains very close to us, especially in the field of sustainable development, because she is ahead of her time on this front," noted Pinot, adding that McCartney is still on the board of directors of the Kering Foundation.

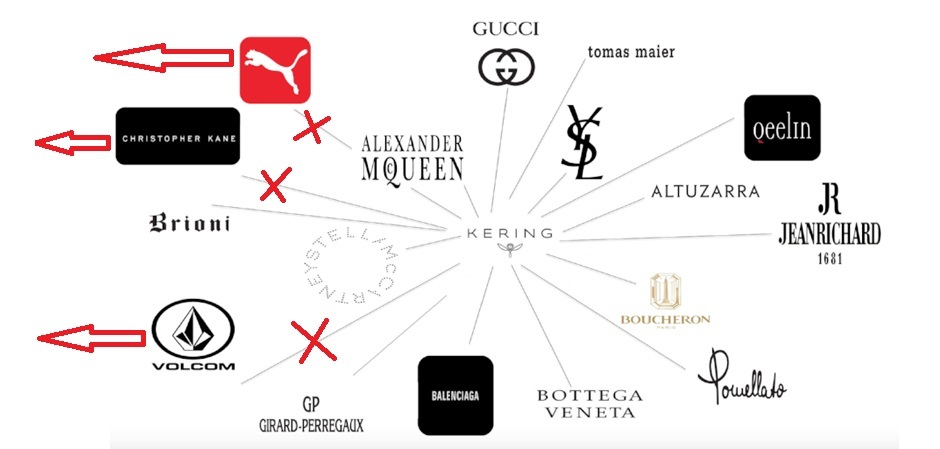

Although Kering has significantly reduced its brand portfolio in recent years, parting with Stella McCartney, as well as with Christopher Kane, separating Puma and having sold Volcom, analysts suspect that the company may make a major acquisition in order to continue to bring profit to shareholders. In 2018, dividends amounted to 10.50 euros per share, which is 75% more than 6 euros per share a year earlier. According to the managing director of the group, Jean-Francois Palace, most of this value was due to direct retail sales, which account for 77% of the group's revenue. The group's trade turnover in direct retail increased by 31% in 2018, and online sales increased by 71% compared to 2017.

If Kering makes a new purchase, it will most likely be from the main sphere of its activity: luxury goods, accessories and jewelry. In particular, Pinot announced that the group will refrain from the category of wines and spirits, which in 2018 brought its competitor, LVMH group, 5.14 billion euros. "We can't do everything. We are lucky to have a portfolio of brands that are among the most important in their categories internationally... Today there is no point in moving to another sector when we realize the importance of the potential that awaits us," commented on this strategy Pinot.

It is also extremely important for Kering to maintain the demand for its most popular brands, especially for Gucci, which in the first quarter of fiscal 2019 reported sales of 2.3 billion euros, which is 20% more than a year earlier. This pace, although much faster than in the luxury goods market as a whole, was a decline compared to growth in the first quarter of 2018, when Gucci reported a 49% jump in sales.

Pinot confirmed that in June Gucci will present its first collection of haute couture jewelry. "I am convinced that we can achieve more success in beauty," Pinot noted, adding that about 70% of Gucci's sales are from permanent collections that ensure stability. The brand's online sales, which grew by 70% in 2018, are expected to exceed 1 billion euros in the medium term.

Shareholder approval of Pinot's salary in 2018 was only 78.74 percent, which is noticeably lower than in previous years (83.21% for his salary in 2017 and 88.84% for his salary in 2016). This is due to the fact that this time Pinot was paid significantly more than ever in the past: almost 22 million euros compared to 2.75 million euros in 2017. The jump, widely covered by the French media in the last few weeks, was due to the compensation package created by the company in 2013 and spurred on by the company's good performance last year. For comparison, last week at the annual meeting of LVMH, 84.11% of shareholders approved compensation for CEO Bernard Arnault for 2018 in the amount of 4.48 million euros. However, despite less activity in approving Pinot's salary, the shareholders of Kering approved the preservation of the compensation package in 2019.

Author: Tatiana Egorova

Photo: from open sources