There are central streets

part 1 part 2 part 3 part 4 part 5

PUT ON THE CENTER

Thanks to the attraction of the streets to inexpensive food and spontaneous low-budget purchases, Knight Frank talks about the democratization of street profiles that has already come, now focused more on pedestrians than on wealthier motorists, and predicts its strengthening. Thanks to these trends, in three years, the vacancy in street retail within the TTK has noticeably decreased from 5.9% to 1.9%, since there are simply more mass segment operators and the demand for them is higher than for luxury, the company reports. Rental rates have also received a boost for growth - on average, they have increased by 11 - 29%. Vacancy on central pedestrian streets Moscow amounted to 2.1%, on the central transport and pedestrian corridors - 7.4%, while decreasing, compared with 2017, by 3.8% and 1%, respectively.

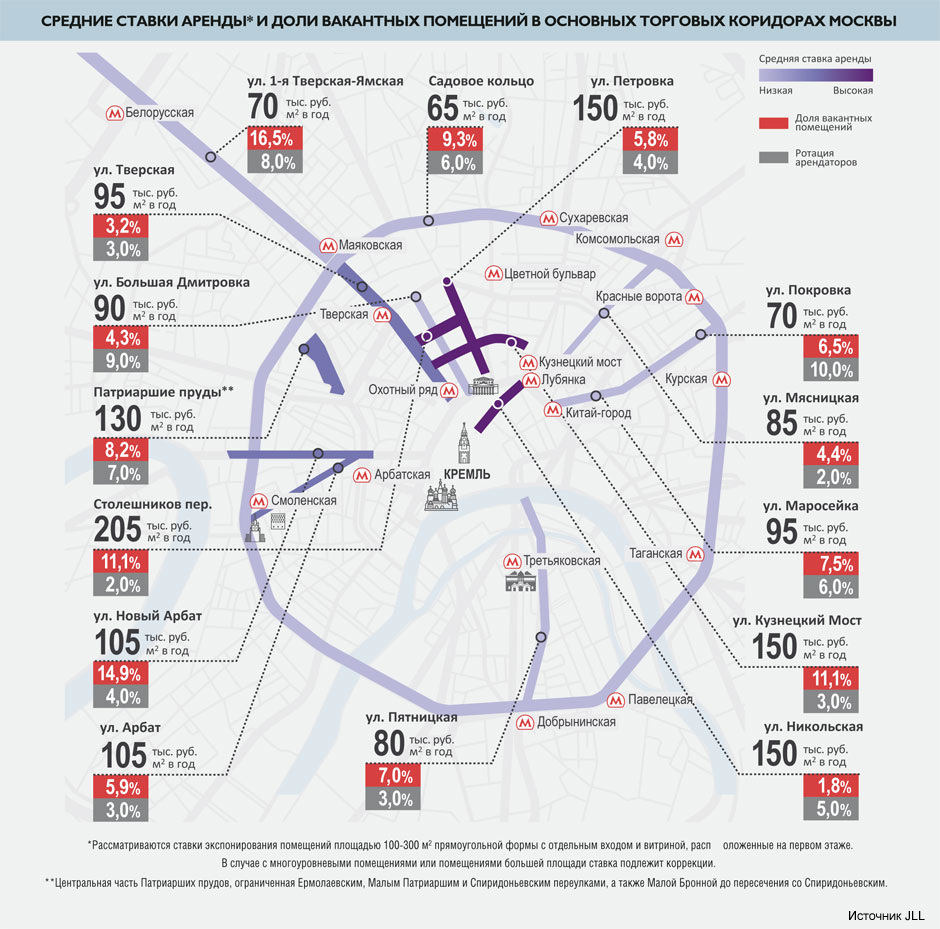

The highest stakes in In Moscow in 2018, according to Knight Frank, recorded in Stoleshnikov Lane and on the streets Kuznetsky Bridge, Nikolskaya and Tverskaya (on the site from the metro station Okhotny Ryad to the metro station. «Pushkinskaya»). Reduction of the upper limit of the rental rate in most key shopping corridors of the city by 8-18%, depending on the street.

The minimum amount of bids in 2018 has not changed and amounted to 30 thousand rubles per 1 m2 per year (Prospect Mira, Garden ring). Changes in the direction of decreasing the lower border are fixed at Tverskaya (from 60 to 45 thousand rubles/m2), Novy Arbat (from 60 to 40 thousand rubles/m2), Myasnitskaya (from 55 to 45 thousand rubles/m2). Increasing the betting range by Pyatnitskaya – from 30–120 thousand rubles/m2 to 36–130 thousand rubles/m2. Rental rates on Kuznetsk Bridge, in turn, shifted towards lowering the lower border from 70 to 65 thousand rubles/ m2 and increasing the upper one from 200 to 220 thousand rubles/ m2. Such dynamics is connected, on the one hand, with the reduction of vacant spaces on the listed streets, on the other hand, with active demand from tenants working in the mid-price and lower price segments.

"The situation in the Moscow street retail market is becoming clearer, which in professional assessment is called the "border effect", states Oksana Kopylova, Head of retail and warehouse real estate analytics at JLL. Its essence boils down to the fact that premises with similar quality characteristics, located in the same location, on the same street, but in different places from the point of view of traffic, may have rates that differ at times. A striking example of this is Kuznetsky Bridge, where the premises in the house opposite the Central Department Store on the segment from Neglinnaya to Petrovka are offered at a rate of 2–3 times higher than on other sections of the street.

"There is a fluctuation in rental rates on many central streets (Tverskaya, Stoleshnikov, Kutuzovsky Prospekt), – agrees Olga Yarullina from S.A. Ricci. – Somewhere the landlord is forced to make concessions, somewhere (for example, in locations with existing traffic and the possibility of organizing parking) the tenant is already making a compromise. Today, when choosing a room, one of the weighty factors for the tenant has become the reputation and adequacy of the owner of the premises, as well as the ability to quickly agree on lease terms and operational matters (repairs, signage, entrances, utilities, etc.). The actual moment is the search for a compromise between the desires and requirements of the tenant and the landlord. As for the lease agreements themselves, there are no significant changes. It can be noted that the adoption of the VAT increase reform now encourages the parties to include in the contract a phrase referring to the current legislation. And in already existing contracts concluded before the reform, the VAT clause becomes a matter for discussion by the parties.

As a result, the vacancy rate decreased most actively in 2018 by Tverskaya Street, where the indicator for the year decreased by 5.1 percentage points and amounted to 3.2%, Bolshaya Dmitrovka (-4.3 percentage points to 4.3%) and Nikolskaya (-3.5 pp. – up to 1.8%), they say in JLL. The largest vacancy is on Kutuzovsky Prospekt (about 25%). Experts believe that this area has become less attractive to the target audience after the deterioration of transport accessibility and a decrease in the number of parking spaces.

"It should be noted that in recent years some streets have radically changed their appearance: for example, the same Tverskaya, which was previously considered a street of luxury boutiques and expensive restaurants, ceased to be such after the renovation works of 2016–2017, during which it was partially blocked, – reports Olga Yarullina. – Now we are seeing a decrease in rates and a drop in the cost of the consumer basket – the corridor has changed, focusing on pedestrian traffic. New stores offer products of the middle price segment and even mass market. So, in 2015, a two-storey Lush store was opened, and in 2017, a number of flagship stores were opened at once: My AUCHAN, H&M, Natura Siberica. A relatively inexpensive "Clean Line" and fast casual cafe Prime" have opened.

Author: Ekaterina Reutskaya

Photo: from free sources